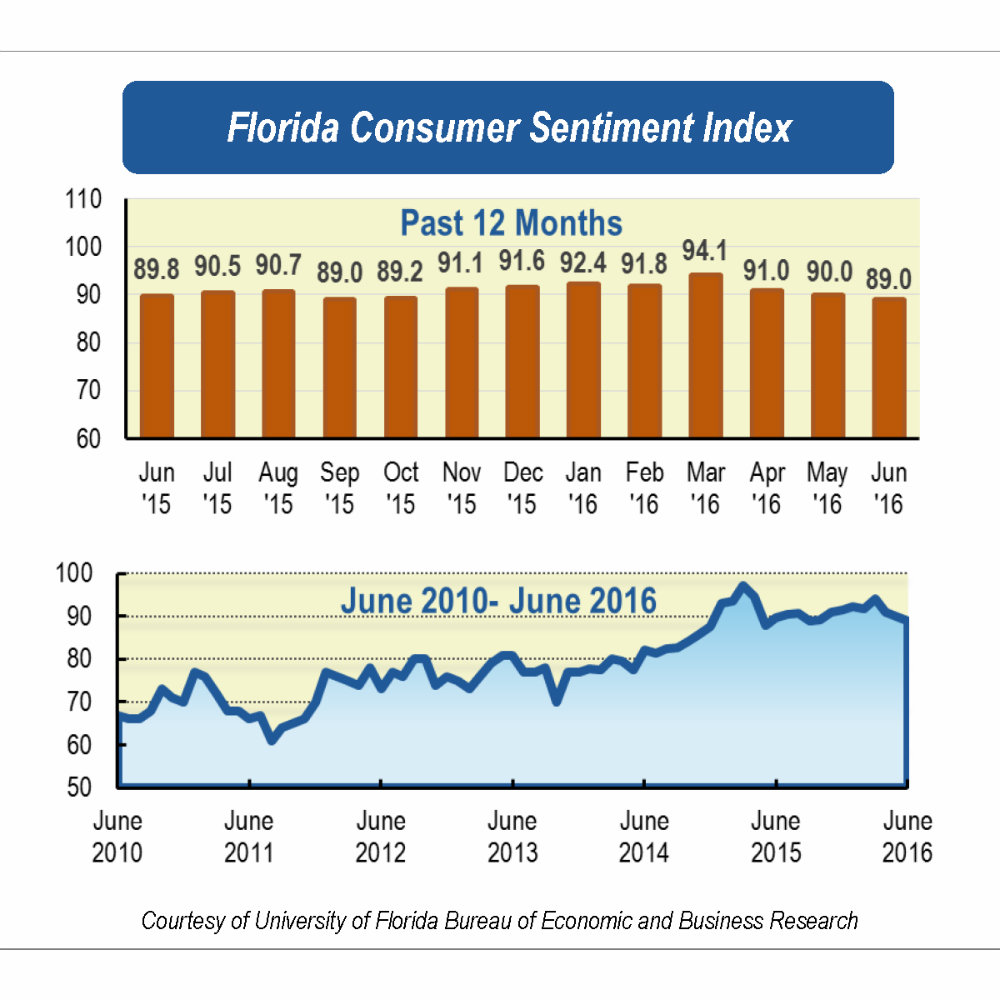

Consumer sentiment among Floridians dropped again in June to 89, one point down from May’s revised reading and tied with September 2015 for the lowest reading in the last 18 months, according to the latest University of Florida consumer survey.

Of the five components that make up the index, three decreased and two increased.

Perceptions of one’s personal financial situation now compared with a year ago showed the sharpest drop, falling 3.5 points from 85.5 to 82.0. This decline was shared by all Floridians except those with income above $50,000, whose reading rose 4.3 points. In contrast, those with annual incomes under $50,000 dropped 7.4 points from last month.

Opinions as to whether now is a good time to buy a big-ticket item such as an automobile went up slightly, from 94.2 to 95.4, but again the perceptions of those with income below $50,000 went down.

“The trend of these two components together over the past three months indicates that perceptions of current economic conditions have deteriorated among Floridians, but this pessimistic sentiment started a month earlier for those with annual incomes under $50,000,” said Hector H. Sandoval, director of the Economic Analysis Program at UF’s Bureau of Economic and Business Research.

Expectations of personal finances a year from now were also down slightly, from 102.5 to 101.7.

Views of the future national economy were mixed: Expectations of U.S. economic conditions over the next year rose half a point to 83.4, while expectations of U.S. economic conditions over the next five years decreased 2.3 points, from 84.9 to 82.6.

Florida consumer sentiment is suffering a three-month decline even as some economic indicators are positive. According to the latest report from the U.S. Bureau of Economic Analysis, Florida’s state Gross Domestic Product ranked fifth in the nation for the fourth quarter of 2015.

Florida’s unemployment rate declined again in May, dropping one-tenth of a percentage point to 4.7 percent. The number of jobs added in May statewide was 253,900, a 3.2 percent increase compared with last year. Florida’s economy is growing, with more jobs added every month for 70 consecutive months.

“While the decline in the sentiment index was marginal, it’s worth noting that this is the third straight month of declines,” said Christopher McCarty, director of UF’s Bureau of Economic and Business Research. “The national and international context may contribute to further declines over the next few months. As the campaigns for U.S. president get in full swing, it’s not unusual to see drops in sentiment as consumers hear negative economic opinions and anticipate what each candidate might do.”

McCarty also pointed to potential challenges in the months ahead.

“There are lingering problems with weak wage growth and lower-than-expected inflation, reflecting tepid demand,” McCarty said. “Internationally, many economies, such as Europe and Japan, are struggling with very low inflation and addressing it through negative interest rates. Britain’s very close vote to leave the European Union will have an enormous effect on U.S. and Floridian consumer sentiment in the coming months. The immediate effect will be through a sharp fall in the stock market as most investors did not truly believe this would happen, so the result has not been factored into current prices. This will only be the beginning of the consequences of this move. Other European countries may also decide to leave the EU which could lead to a wave of protectionism that will affect international trade markets for quite some time. Much like the last recession we are in uncharted territory.”

Conducted June 1-20, the UF study reflects the responses of 406 individuals who were reached on cellphones, representing a demographic cross-section of Florida.

The index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is a 2, the highest is 150.

Details of this month’s survey can be found at http://www.bebr.ufl.edu/csi-data