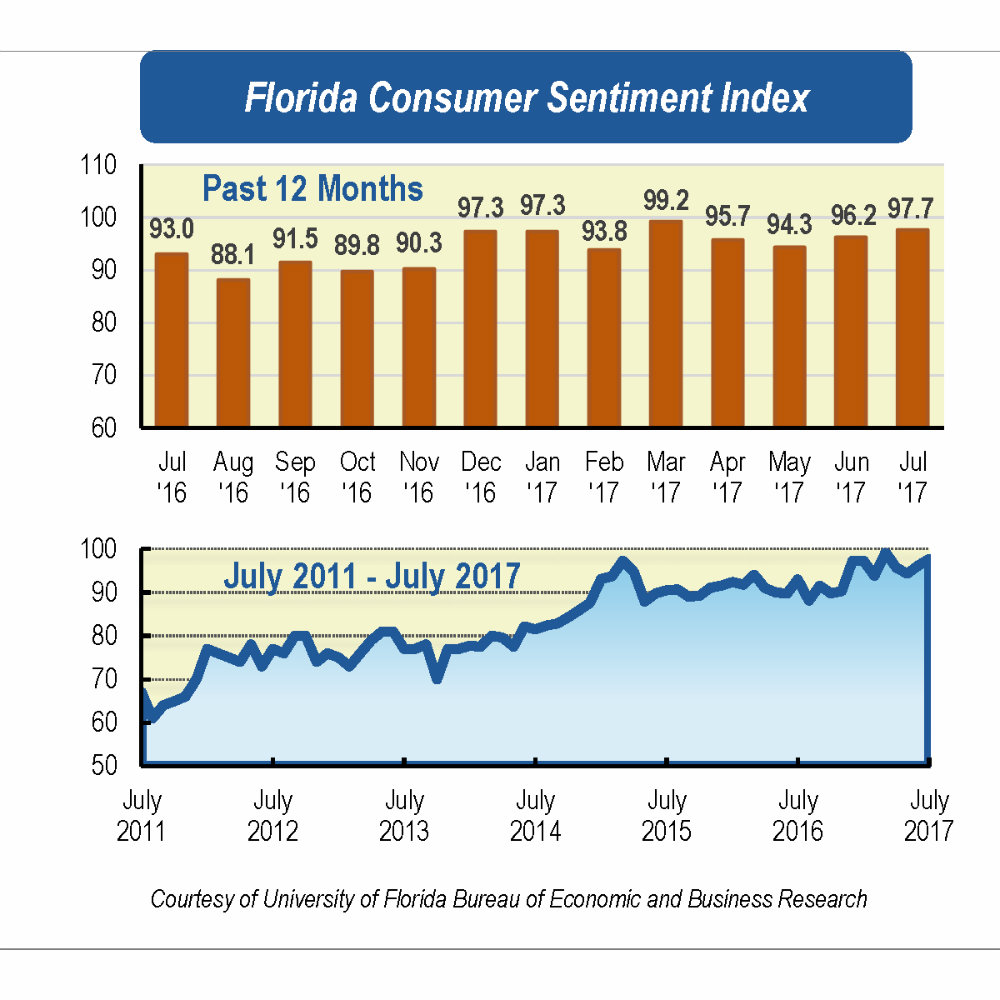

Consumer sentiment among Floridians rose 1.5 points in July to 97.7, the second-highest reading since March 2002.

Among the five components that make up the index, three increased and two decreased.

Perceptions of one’s personal financial situation now compared with a year ago showed the greatest drop in this month’s reading, down 2.7 points from 91.1 to 88.4.

“However, perceptions are divided across the population. Women, people 60 and older, and those with annual income under $50,000 held very positive views about their personal finance situation,” said Hector H. Sandoval, director of the Economic Analysis Program at UF’s Bureau of Economic and Business Research.

Opinions as to whether now is a good time to buy a major household item such as an appliance increased 1.5 points, from 102.1 to 103.6.

“Overall, perceptions about current economic conditions have deteriorated slightly among Floridians in July as a consequence of the pessimism among the men and those under age 60,” Sandoval said.

Expectations of personal finances a year from now ticked down nine-tenths of a point, from 104.7 to 103.8.

Expectations of U.S. economic conditions over the next year showed the greatest increase in this month’s reading, up six points from 91.8 to 97.8. Additionally, expectations of U.S. economic conditions over the next five years rose 4.1 points, from 91.1 to 95.2.

“Floridians are more optimistic,” Sandoval said. “The gain in July’s sentiment came from consumers’ future expectations about the economy in the medium and long run. Remarkably, these positive expectations are shared by Floridians across all demographics and economic levels.”

Since the beginning of the year, Florida’s labor market has strengthened, with solid job gains every month. Between January and June, the Florida unemployment rate declined by nine-tenths of a percentage point, from 5 to 4.1 percent, reaching the lowest rate since a decade ago, in July 2007—just before the Great Recession.

Moreover, the labor force in Florida reached over 10 million workers in February. According to the U.S. Bureau of Economic Analysis, in the first quarter of 2017, Florida’s gross state domestic product increased 1.4 percent and personal income grew 1.3 percent. The leading contributors to personal income growth for Florida were net earnings and transfer receipts, which include benefits received by persons from federal, state and local governments and from businesses for which no current services are performed.

In view of the labor market conditions and inflation nationwide, last week the Federal Reserve decided to maintain the target range of the federal funds rate between 1 and 1.25 percent to support further strengthening in the labor market.

“The positive economic outlook in the first half of the year brought consumer sentiment in Florida to its highest levels in the last 15 years. There’s no evidence that economic conditions will change in the short run, thus high sentiment levels should persist in the second half of the year,” Sandoval said.

Conducted July 1-27, the UF study reflects the responses of 461 individuals who were reached on cellphones, representing a demographic cross section of Florida.

The index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is a 2, the highest is 150.

Details of this month’s survey can be found at http://www.bebr.ufl.edu/csi-data